Balance Sheet Example Template Format Analysis Explanation

Angela is certified in Xero, QuickBooks, and FreeAgent accounting software. To simplify bookkeeping, she created lots of easy-to-use Excel bookkeeping templates. This gives you a percentage showing how much the company is financed by debt.

Basic Balance Sheet Statement

Total liability is typically ordered with total current liabilities first and then non-current liabilities. This register serves as a comprehensive record, detailing all the information about each asset owned by your business. Not only does it help in tracking the value and condition of your assets over time, but it also plays a vital role in financial management, ensuring accurate depreciation calculations. Assets can be split into three sections – current assets, fixed assets, and intangible assets. This equation must always balance, ensuring that the company’s resources are financed by either debt or equity. At a corporation it is the residual or difference of assets minus liabilities.

A. Assessing Financial Health and Stability

It’s important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from comparative financial statements definition a US company, it would adhere to Generally Accepted Accounting Principles (GAAP). If a company or organization is privately held by a single owner, then shareholders’ equity will be relatively straightforward.

- A balance sheet is a financial document that you should work on calculating regularly.

- It is also a valuable tool for management to know the value of assets a business owns, including equipment, bank balance and what it owes at any given time.

- Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper.

The debt-to-equity ratio

The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day. This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day.

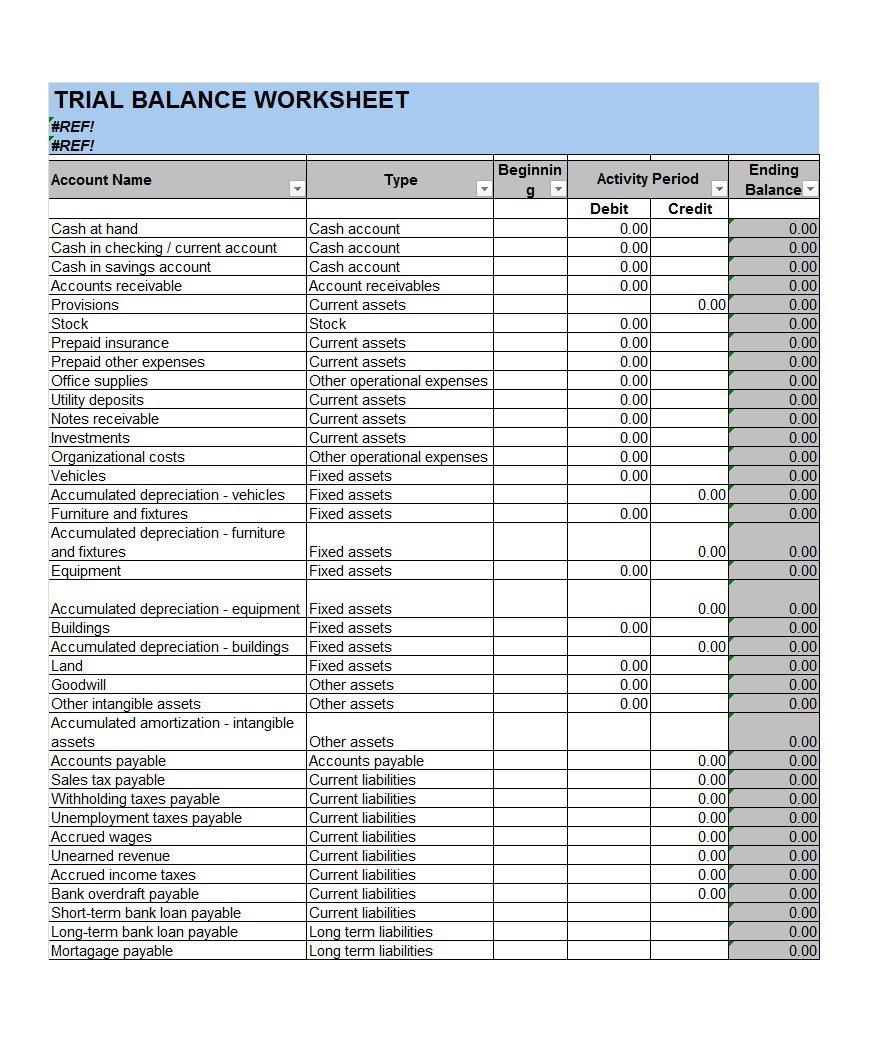

Examples of such assets include long-term investments, equipment, plant and machinery, land and buildings, and intangible assets. Most of the information about assets, liabilities, and owners’ equity items is obtained from the adjusted trial balance of the company. However, retained earnings, a part of the owners’ equity section, is provided by the statement of retained earnings. Although the insights from comparative balance sheets are many, there are few caveats for their use in analyzing financial data. The balance sheet is an important component of financial reporting, which refers to the process of preparing and presenting financial statements.

In contrast, a comparative balance sheet compares financial data across multiple periods, typically two or more, allowing businesses to analyze how their financial position has changed over time. The balance sheet is one of the three primary financial statements used by businesses to assess their financial health. The other two financial statements are the income statement and the cash flow statement. Together, these three statements provide a comprehensive view of a company’s financial position and performance. By comparing your business’s current assets to its current liabilities, you’ll get a clearer picture of the liquidity of your company. It’s wise to have a buffer between your current assets and liabilities to at least cover your short-term financial obligations.

Assets – Fixed Assets, Current Assets, intangible assets, stock, cash, money owed from customers (accounts receivable ledger) and prepayments. Cash flow and income statements are also pivotal in corporate finance and accounting. For example, if a company’s debt-to-equity ratio is much higher than the industry average, it may suggest higher financial risk or reliance on debt. Understanding industry benchmarks provides context and helps you evaluate a company’s financial position more effectively.

Assets are resources that a company owns or controls and that have future economic benefits. They are typically listed on the balance sheet in order of liquidity, meaning the ease with which they can be converted into cash. Examples of assets include cash, accounts receivable, inventory, and property, plant, and equipment. Assets are resources that a company owns or controls, such as cash, inventory, property, and equipment. Liabilities are obligations that a company owes to others, such as loans, accounts payable, and taxes. Equity represents the residual value of a company’s assets after its liabilities have been paid off.

For instance, a growing trend in retained earnings or assets may signal a healthy and expanding business, making it more attractive to investors. On the other hand, increasing liabilities or declining assets could be red flags, prompting further investigation before making an investment decision. It also helps investors assess a company’s ability to pay dividends and reinvest in growth opportunities. A comparative balance sheet enables businesses to compare their financials for multiple periods of time.

A comparative balance sheet analysis provides insight into a business’s debt management to financial growth in assets. Let’s look at what a comparative balance sheet is, format, formulas and techniques for effective analysis. The balance sheet can provide insights into a company’s profitability by looking at the relationship between its assets and liabilities. One commonly used ratio is the debt-to-equity ratio, which measures the amount of debt a company has relative to its equity.

Leave a Comment