California Income Tax: Rates, Who Pays in 2024-2025

Therefore, we work to ensure the diverse families we serve are welcomed, included, and treated equitably with compassion. And we work to support economic and social policies and practices that promote inclusion and equity and to oppose those that do not. To stand in solidarity with those we serve, it’s not enough to lift our voices against these policies, rather together we must also lift our hands to help and to heal our communities. We are called first to listen to those we serve, then to discern how best to support them, and finally to act with compassion. In times of crisis, whether from a natural disaster or from a sudden economic, social, or political change, at Catholic Charities we stay true to our mission of changing lives for good.

Tax Data Sources:

- Please call to schedule the drop off of your tax records or upload them onto the portal under your account.

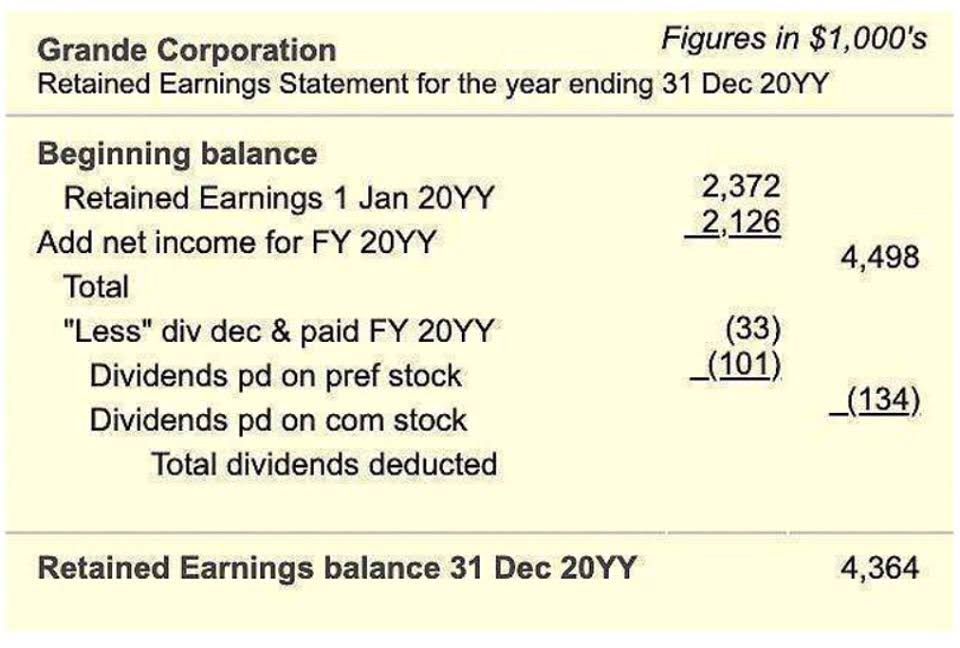

- The table below further demonstrates tax rates for Californians.

- The local firm also conducts business planning and management, such as entity selection and startup services.

- Tim Kehl, CPA is a licensed full-service and premier accounting firm serving the San Jose, CA area, and its neighboring counties.

- 911 Tax Relief addresses clients’ financial-related issues in San Jose.

The city of San Francisco levies a gross receipts ledger account tax on the payroll expenses of large businesses. Although this is sometimes conflated as a personal income tax rate, the city only levies this tax on businesses themselves. While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

- The standard deduction in California is $5,202 for single filers and $10,404 for joint filers.

- California allows taxpayers to report gains and losses from the sale of capital assets.

- Bonuses and earnings from stock options are taxed at a flat rate of 10.23%, while all other supplemental wages are taxed at a flat rate of 6.6%.

- While the income taxes in California are high, the property tax rates are fortunately below the national average.

- But unless you’re getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract.

How do I file a tax extension?

Andrade Tax Service is a family-owned and family-operated san jose income tax company serving individuals and businesses in San Jose. It provides tax return preparation and planning services for individuals, partnerships, and limited liability companies. The company also offers payroll processing and bookkeeping services to maintain accurate and complete records of financial transactions in an orderly manner. Andrade Tax Service uses its 40 years of industry experience to meet the tax service needs of clients in a dynamic regulatory and financial environment.

About San Jose, California

Proposition 13, passed by California’s voters in 1978, sets the maximum allowable property tax rate at 1% of a home’s assessed value. It also limits increases in assessed value to 2% every year, except if the home has changed ownership or undergone construction. That law has helped keep Californians’ property tax payments below the national average, and in some cases, significantly so. It covers frequently asked questions like understanding business travel deductions and how military members and their families can receive help with their taxes at no cost.

Capital Gains Taxes

The average homeowner pays just 0.75% of their actual home value in real estate taxes each year. Global Gate Tax Relief and Accounting helps San Jose residents and businesses improve their finances and regulatory compliance. Its CPAs, case managers, and Enrolled Agents handle tax services, including IRS representation, wage garnishment prevention, and penalty abatement. In addition, they assist with the IRS Fresh Start Program, innocent spouse tax relief, and tax collection appeals.

- They also manage various tax forms, such as 1040s, 1099s, and 1120s, for the self-employed and entrepreneurs.

- The insurance tax is one of the largest sources of revenue for the state’s general fund.

- Located in downtown San Jose, Saigon Taxes has been serving not only clients within the Bay Area vicinities but also providing services to clients in other States.

- It provides customized personal and business tax preparation and return filing solutions to help clients protect their finances.

- Before you stress, we’re here to share some guidance for filing.

- The California Franchise Tax Board recently released tax changes for the 2024 tax year (taxes filed in 2025).

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your company’s insurance offerings. In California, these supplemental wages are taxed at a flat rate. Bonuses and earnings from stock options are taxed at a flat rate of 10.23%, while all other supplemental wages are taxed at a flat rate of 6.6%. These taxes will be reflected in the withholding from your paycheck if applicable. A taxpayer may deduct a casualty loss caused by a disaster declared by the President or the governor. The damage must be sudden, unexpected or unusual from an earthquake, fire, flood or similar event.

Leave a Comment