How a General Ledger Works With Double-Entry Accounting Along With Examples

It also showcases the amount you pay to your suppliers or the amount yet to be paid for any purchases. As a result, each transaction of your business takes place in such a way that this equality between the two sides of the accounting equation is always maintained. That is, at any point in time, the resources or the assets of your business must equate to the claims of owners and outsiders.

What are trial balances?

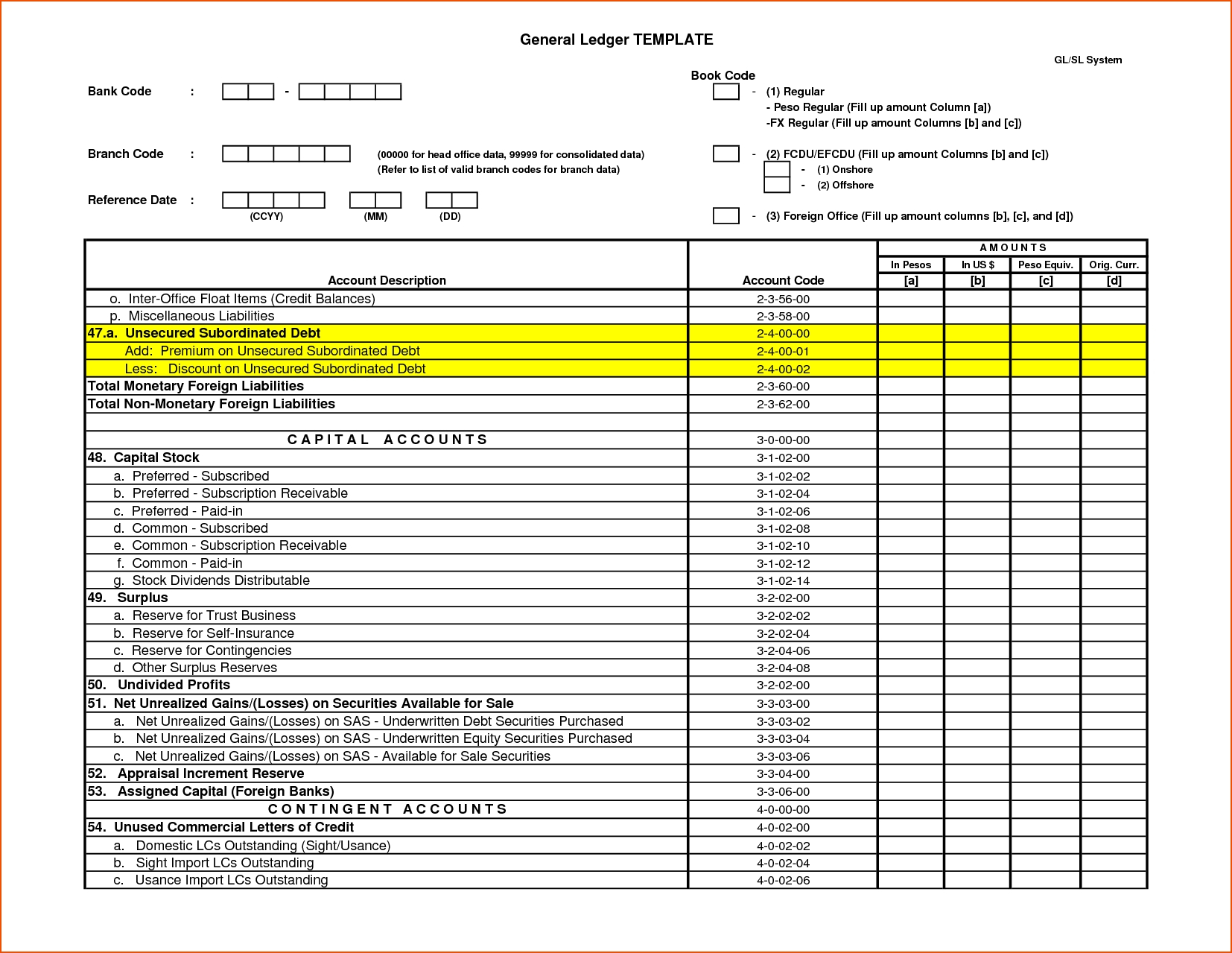

General ledger codes are the numeric codes assigned to different General Ledger Accounts. These accounts help in organizing the general ledger accounts properly and recording transactions quickly. For example, you’ll need to record rent expenses every month if you rent computers and decide to prepay the rent in January for the next twelve months. This is done because you do not want to understate any expenses in your financial statements for the next 12 months.

General Ledger Trial Balance Report

Nick Gallo is a Certified Public Accountant and content marketer for the financial industry. He has been an auditor of international companies and a tax strategist for real estate investors. He now writes articles on personal and corporate finance, accounting and tax matters, and entrepreneurship.

See if you’re eligible for business financing

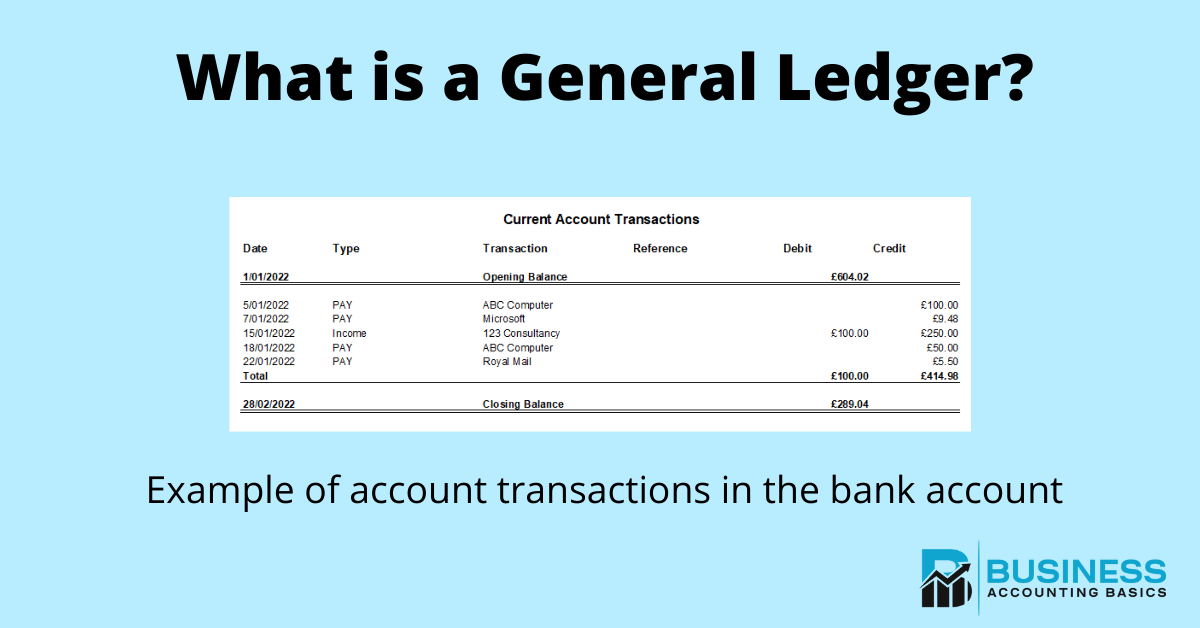

Include the account names and numbers, the date of each financial transaction, a reference number, a debit column, a credit column, and a balance column. You may also include a space for a short description of each transaction, for better clarity on your cash flow. You need to check the transaction amounts recorded as part of your general ledger. If you are preparing your general ledger manually, you will have to keep your source documents handy.

Data-Backed Tips for Running a Successful Business

This means you first need to record a business transaction in your journal, and remember to record them in the order in which they occur. Once you record the transaction in the journal, you’re then required to classify and transfer it into a specific general ledger account. Equity is the difference between the value of the assets and the liabilities of the business. If the business has more liabilities than assets, it can have negative equity. Equity can include things like common stock, stock options, or stocks, depending on if the company is privately or publicly owned by owners and/or shareholders. Now let’s move on to talk about debits vs. credits and how they work in an accounting system.

General Ledgers and Double-Entry Bookkeeping

As your company grows, you can use the GL to track where your money is going and where it is coming from, using this data to make future business decisions. Where once all journal entries and general ledger accounts were manually recorded by hand, now technology can automate the accounting process. Quality accounting systems have become a staple for small businesses everywhere, as they are essential to the management of accounts and organized record keeping. A general ledger or accounting ledger is a record or document that contains account summaries for accounts used by a company. In other words, a ledger is a record that details all business accounts and account activity during a period. You can think of an account as a notebook filled with business transactions from a specific account, so the cash notebook would have records of all the business transactions involving cash.

- We discuss the process of balancing the account in our post on balancing off accounts.

- The account details can then be posted to the cash subsidiary ledger for management to analyze before it gets posted to the general ledger for reporting purposes.

- For many auditors, the general ledger for the year is a standard request in their prepared by client (“PBC”) documents.

- “As transactions in your business occur, they are noted in the general ledger under each account using double-entry accounting.

- To avoid unnecessary posting errors it is important to keep the number of ledger accounts to a minimum.

These sources will help to verify that the amounts recorded in the ledger accounts are accurate. Income statement accounts, like operating and non-operating income, and expenses start afresh with every accounting period. So, at the beginning of the accounting period, these accounts must have a NIL balance.

Adjusting entries are prepared at the end of an accounting period to consider income or expenses that have not yet been recorded in the general ledger. As a result, these entries can be for accrued expenses, accrued revenues, prepaid tips for sales tax compliance in e expenses, deferred revenues, and depreciation. In each accounting period, entries and account listings are compiled into the essential financial statements of a business, including the balance sheet and income statement.

Leave a Comment