How Smart Technologies are Revolutionizing the Auto-Insurance Industry

How Smart Technologies Are Revolutionizing the Auto-Insurance Industry

With technological revolution taking over just about every industry, the applications of the likes of machine learning, artificial intelligence, etc. are no less relevant to the auto insurance industry. Auto insurance industry is undergoing a major transformation with the advent of smartphones, predictive analytics, smart contracts, and blockchain technology. This will lead to increased efficiency, lower costs, and better solutions for customers.

With technological revolution taking over just about every industry, the applications of the likes of machine learning, artificial intelligence, etc. are no less relevant to the auto insurance industry. Auto insurance industry is undergoing a major transformation with the advent of smartphones, predictive analytics, smart contracts, and blockchain technology. This will lead to increased efficiency, lower costs, and better solutions for customers.

Developers are currently creating applications and artificial intelligence to speed up claim processing and manage large amounts of data. Insurance companies are also utilizing predictive analytics technologies to assess the behavioral habits of drivers and develop insurance packages with pricing based on that analysis. Furthermore, autonomous vehicles are now applying telematic devices or black box insurance to develop risk profiles for autonomous vehicles. The market predictors forecast that the global market for telematics in fleet management will reach $11.5 billion by 2021, with a compound annual growth rate (CAGR) of 18%. These devices are also able to track high-risk drivers and stolen vehicles to improve on-road safety.

Generally, all the big companies are testing waters with smart technologies in auto insurance management. This article examines smart technologies in the auto insurance industry and highlights key players. This includes TomTom, Fleetmac Group, KORE, and Allstate Drivewise, as well as various startups.

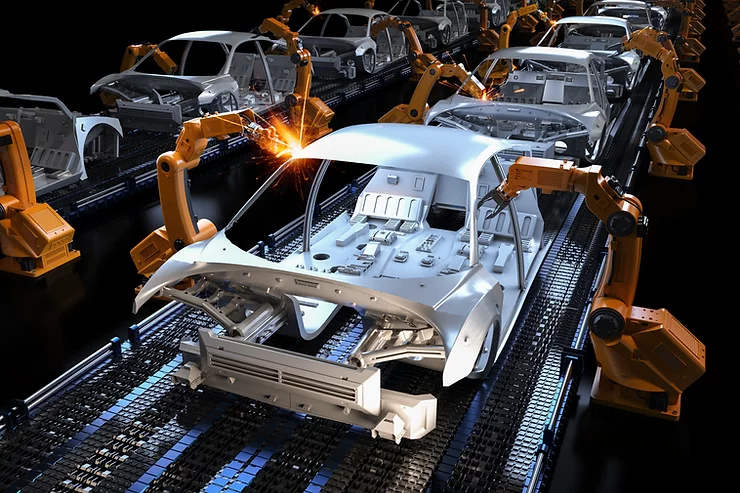

Workflow Automation and Robotics in the Insurance Industry

Auto insurance companies deal with comprehensive paperwork, underwriting and follow-ups on a daily basis. Automation helps companies save costs and labor hours, allowing the workforce to focus on more important tasks. Fukoku Mutual Life Insurance replaces 34 employees with AI, increasing productivity by over 30%.

Along the same lines, Robotic Process Automation (RPA) addresses routine and repetitive work efficiently by applying human designated instructions. PZU, a European auto insurance company, improved data entry accuracy by 100% and streamlined damage claim analysis. They utilized UIPath, including auto insurance, banking, healthcare, and manufacturing.

Automation in Claim Processing – Auto Insurance Industry

Conventionally, processing claims is a cumbersome process that takes a lot of time. Before making a payout decision, the auto-insurance company needs to collect a significant amount of data and evidence. ML is helping to reduce the time and cost of claim processing by analyzing incident footage and landscape imagery. This eliminates the need for significant human effort, time, and cost.

State Farm is an artificial intelligence company, specializing in object recognition technology applications. The company has developed a claim reporting application that uses object recognition technology to help make auto-insurance claims easier. With the use of technology, users can capture images and videos of the insured vehicle and incident, which automatically populates data into a claim. Submitting claims from anywhere and eliminating the need to manually type policy information is possible with this technology.

Telematics insurance

Telematics insurance is a state-of-the-art technological auto insurance industry to manage road accidents better. The installation of telematics devices equipped with GPS systems, motion sensors, and analytics software is done directly onto a vehicle. These devices are able to track car speed, location, driving distances and crash accidents, etc., along with other driving-related data. The telematics device records the data and sends it to the insurance company for analysis via the mobile Internet. The insurance company credits the analysis to the customer’s personal account. After analyzing the gathered data using analytics software, insurance companies are able to make tailored insurance plans for users.

Auto insurance industry can segment users on the basis of charging them for irresponsible driving and sending rewards for safe driving. Telematics technology enables the application of business models such as pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and usage-based insurance (UBI). UK-based telecommunications giant O2 has launched a telematics-based car insurance product that detects driving habits and scores of drivers on its mobile application. Drivers also get rewarded for driving safely and are able to view their data.

Peer-to-Peer (P2P) insurance

P2P insurance is a popular and highly advanced business tool that allows auto insurance companies to form a network of people that cover similar risks by creating a single finance pool. The insurance company refunds the leftover money in the pool to customers at the end of each coverage period, allowing them to minimize costs and mitigate claim conflicts.

A good example of a P2P insurance network is Friendsurance, which forms groups of up to 16 people connected via a mobile app. With this network, whenever a vehicular accident occurs, the incident is claimed for via Friendsurance and is covered. When the contract expires, all members of the pool get pre-agreed cashbacks from funds available in the pool. P2P in auto insurance is still at a nascent stage of development and is prone to drawbacks such as fraud, ethical issues among members and difficulty in achieving consensus.

Future prospects

Digital technologies are disrupting auto-insurance industry and creating personalized, efficient workflows for users. Automation of routine tasks saves on labor and costs. While machine learning algorithms for assessing incidents and processing claims reduce time requirements. Furthermore, telematics and P2P insurance technologies are enabling newfound ways to manage insurance, introducing PAYD and UBI models. Smart technologies in the auto-insurance industry can provide accurate risk assessment, proactive decision making, improved customer experience, and fraud prevention.

Leave a Comment