how to create a cryptocurrency

How to create a cryptocurrency

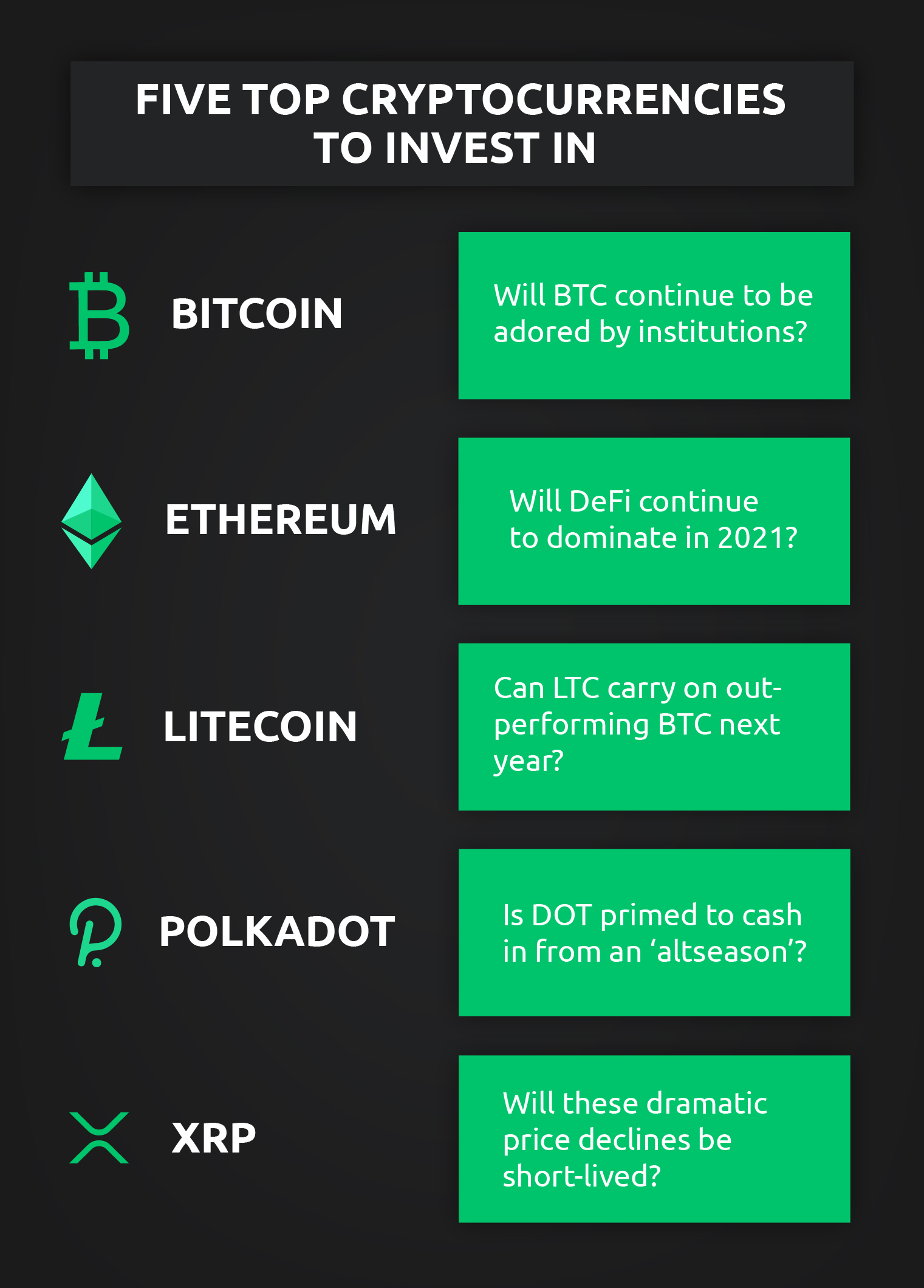

While some cryptocurrencies have seen massive gains in the past, predicting what coin might pull a 1000x return is impossible. For a digital asset to pull this kind of gain, it would have to be a very small, high-risk project. https://angelesings.com/ Investors should thoroughly research any cryptocurrency, understand the risks, and never invest more than they can afford to lose.

Binance Coin (BNB) is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or bitcoin.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Developed to help power decentralized finance (DeFi) uses, decentralized apps (DApps) and smart contracts, Solana runs on a unique hybrid proof-of-stake and proof-of-history mechanisms to process transactions quickly and securely. SOL, Solana’s native token, powers the platform.

Cryptocurrency wallets

Trust Wallet is a non-custodial wallet, meaning that you retain full control over your private keys and funds. This decentralization is key to ensuring the security of your assets, as it minimizes the risk of hacks that can occur with centralized wallets. Trust Wallet employs encryption methods to protect your private keys, giving newbies peace of mind as they start their crypto journey.

DApp browsers are specialized software that supports decentralized applications. DApp browsers are considered to be the browsers of Web3 and are the gateway to access the decentralized applications which are based on blockchain technology. That means all DApp browsers must have a unique code system to unify all the different codes of the DApps.

In contrast to simple cryptocurrency wallets requiring just one party to sign a transaction, multi-sig wallets require multiple parties to sign a transaction. Multisignature wallets are designed for increased security. Usually, a multisignature algorithm produces a joint signature that is more compact than a collection of distinct signatures from all users.

Trust Wallet is a non-custodial wallet, meaning that you retain full control over your private keys and funds. This decentralization is key to ensuring the security of your assets, as it minimizes the risk of hacks that can occur with centralized wallets. Trust Wallet employs encryption methods to protect your private keys, giving newbies peace of mind as they start their crypto journey.

DApp browsers are specialized software that supports decentralized applications. DApp browsers are considered to be the browsers of Web3 and are the gateway to access the decentralized applications which are based on blockchain technology. That means all DApp browsers must have a unique code system to unify all the different codes of the DApps.

How to buy cryptocurrency

Traditional brokerage. Some brokerages through which you can purchase traditional assets like stocks and exchange-traded funds (ETFs) now support crypto coins and tokens, as well. For example, you can buy Bitcoin alongside shares of Apple stock on Uphold or eToro. Keep in mind, though, that some traditional brokerages custody your crypto for you and don’t offer you the option of moving it to a wallet for which you hold the private keys.

It’s important to develop a wider investment plan before committing real funds to a trade. Also, ensure that you thoroughly research your chosen cryptoasset before investing. Given the volatile nature of the crypto markets, it’s crucial that investors only commit capital to cryptocurrency positions that they are willing to lose if the value of the asset was to fall significantly.

Tip: Operational risk, the chance that your broker or platform is a scam or goes bust, applies to all assets, but has historically been higher than average in the crypto sector. Using a trusted and secure trading platform should negate some of this risk.

A soft fork is a change to the Bitcoin protocol wherein only previously valid blocks/transactions are made invalid. Since old nodes will recognise the new blocks as valid, a soft fork is backward-compatible. This kind of fork requires only a majority of the miners upgrading to enforce the new rules.

Leave a Comment