how to invest in cryptocurrency

How to invest in cryptocurrency

The blockchain system acts as a digital public ledger, recording all transactions. Miners or validators check these transactions and get paid for their work. After a transaction is checked and confirmed, the person receiving the money can access it using their secret code, often called a private key.< https://review-casino-au.com/sweet-bonanza/ /p>

As a rapidly expanding landscape of services, DeFi presents a huge number of potential investment opportunities, many of which turn out to be genuinely lucrative, while others turn out to be less attractive than they first appear.

Though not a scam per se, there is a major problem of misinformation in the cryptocurrency industry, which can make it difficult to navigate for new investors. One of the best ways to avoid this is to simply stick to official sources of information and trustworthy news sources. Relying on opinions or word of mouth can be a recipe for disaster.

Investing in cryptocurrency has long been a divisive topic. An emerging asset class, crypto can see dramatic price moves, making it a risky but potentially rewarding option for investors to add to their portfolio. Before you consider investing in cryptoassets, it’s important that you first learn what they are and why they might be a good investment opportunity. Discover the risks of cryptocurrency trading and whether you should believe some of the common myths about crypto.

Best cryptocurrency

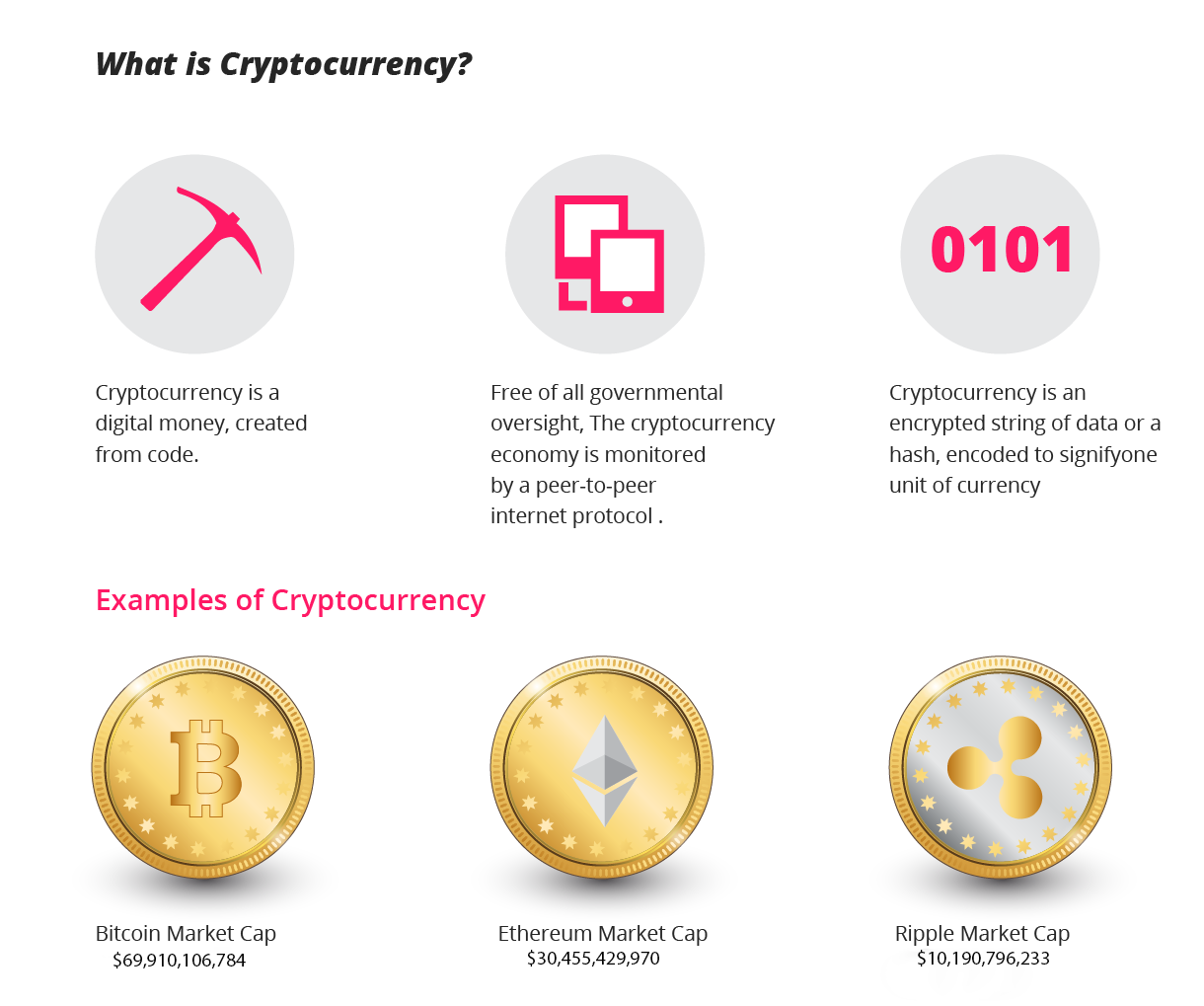

Bitcoin is the most popular cryptocurrency and enjoys the most adoption among both individuals and businesses. However, there are many different cryptocurrencies that all have their own advantages or disadvantages.

A cryptocurrency exchange is a platform that facilitates markets for cryptocurrency trading. Some examples of cryptocurrency exchanges include Binance, Bitstamp and Kraken. These platforms are designed to provide the best possible prices for both buyers and sellers. Some exchanges only offer cryptocurrency markets, while others also allow users to exchange between cryptocurrencies and fiat currencies such as the US dollar or the euro. You can buy and sell Bitcoin on practically all cryptocurrency exchanges, but some exchanges list hundreds of different cryptocurrencies. One metric that is important for comparing cryptocurrency exchanges is trading volume. If trading volume is high, your trades will execute fast and at predictable prices.

An altcoin is any cryptocurrency that is not Bitcoin. The word “altcoin” is short for “alternative coin”, and is commonly used by cryptocurrency investors and traders to refer to all coins other than Bitcoin. Thousands of altcoins have been created so far following Bitcoin’s launch in 2009.

Rae Hartley Beck first started writing about personal finance in 2011 with a regular column in her college newspaper as a staff writer. Since then she has become a leader in the Financial Independence, Retire Early (FIRE) movement and has over 300 bylines in prominent publications including Money, Bankrate and Investopedia on all things personal finance. A former award-winning claims specialist with the Social Security Administration, Rae continues to share her expert insider knowledge with Forbes Advisor readers.

Binance Coin (BNB) is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or bitcoin.

Cryptocurrency meaning

Because there are so many cryptocurrencies on the market, it’s important to understand the types. Knowing whether the coin you’re looking at has a purpose can help you decide whether it is worth investing in—a cryptocurrency with a purpose is likely to be less risky than one that doesn’t have a use.

According to Alan Feuer of The New York Times, libertarians and anarcho-capitalists were attracted to the philosophical idea behind bitcoin. Early bitcoin supporter Roger Ver said: “At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state.” Economist Paul Krugman argues that cryptocurrencies like bitcoin are “something of a cult” based in “paranoid fantasies” of government power.

According to blockchain data company Chainalysis, criminals laundered US$8,600,000,000 worth of cryptocurrency in 2021, up by 30% from the previous year. The data suggests that rather than managing numerous illicit havens, cybercriminals make use of a small group of purpose built centralized exchanges for sending and receiving illicit cryptocurrency. In 2021, those exchanges received 47% of funds sent by crime linked addresses. Almost $2.2bn worth of cryptocurrencies was embezzled from DeFi protocols in 2021, which represents 72% of all cryptocurrency theft in 2021.

In the United Kingdom, as of 10 January 2021, all cryptocurrency firms, such as exchanges, advisors and professionals that have either a presence, market product or provide services within the UK market must register with the Financial Conduct Authority. Additionally, on 27 June 2021, the financial watchdog demanded that Binance, the world’s largest cryptocurrency exchange, cease all regulated activities in the UK.

Because there are so many cryptocurrencies on the market, it’s important to understand the types. Knowing whether the coin you’re looking at has a purpose can help you decide whether it is worth investing in—a cryptocurrency with a purpose is likely to be less risky than one that doesn’t have a use.

According to Alan Feuer of The New York Times, libertarians and anarcho-capitalists were attracted to the philosophical idea behind bitcoin. Early bitcoin supporter Roger Ver said: “At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state.” Economist Paul Krugman argues that cryptocurrencies like bitcoin are “something of a cult” based in “paranoid fantasies” of government power.

Types of cryptocurrency

This is all possible because Ethereum introduced new technology to the crypto world when it launched in 2015. This technology is called a smart contract. A smart contract can automatically execute transactions when certain things happen.

DeFi is more dominant on the Ethereum (ETH) network, which is currently the leading smart contract platform and the second-largest blockchain by market capitalization. Ethereum has benefited from a first-mover advantage in this field, being the first public network to support decentralized apps (dApps) since 2015.

Their tokens don’t have to represent a physical thing like electricity or a house, though. They can instead be used to purchase things on the dApp. Either that, or they can be used to get certain advantages — things like discounted fees and voting fees.

The answer to this question depends on why it is that you’re asking it, in the first place. If you’re wondering about the most popular crypto coin, then, without a doubt, it has to be Bitcoin. If you’re trying to think of a cryptocurrency to invest in, then surely, you might want to look at exchanges that offer you the chance to explore some altcoins.

The coin’s market value has grown over the years, propelling it to be among the ten most valuable blockchain networks. At the back of its success have been several other cryptocurrencies looking to replicate DOGE’s success. Notable among them is the closely dog-themed Shiba Inu (SHIB) project that also experienced explosive growth following its launch in August 2020.

Leave a Comment