Operating Leverage DOL Formula + Calculator

Both of them, when taken together, multiply and magnify the effect of change in sales level on the EPS. Where earnings are either equal to fixed financial charge or unfavorable, debt financing should not be encouraged. If the financial leverage is positive, the finance manager can try to increase the debt to enhance benefits to shareholders. To conclude, financial leverage emerges as a result of fixed financial cost (interest on debentures and bonds + preference dividend). Based on calculations like those shown above, the finance manager can make appropriate decisions by comparing the cost of debt financing to the average return on investment. In fact, financial leverage relates to financing activities (i.e., the cost of raising funds from different sources carrying fixed charges or not involving fixed charges).

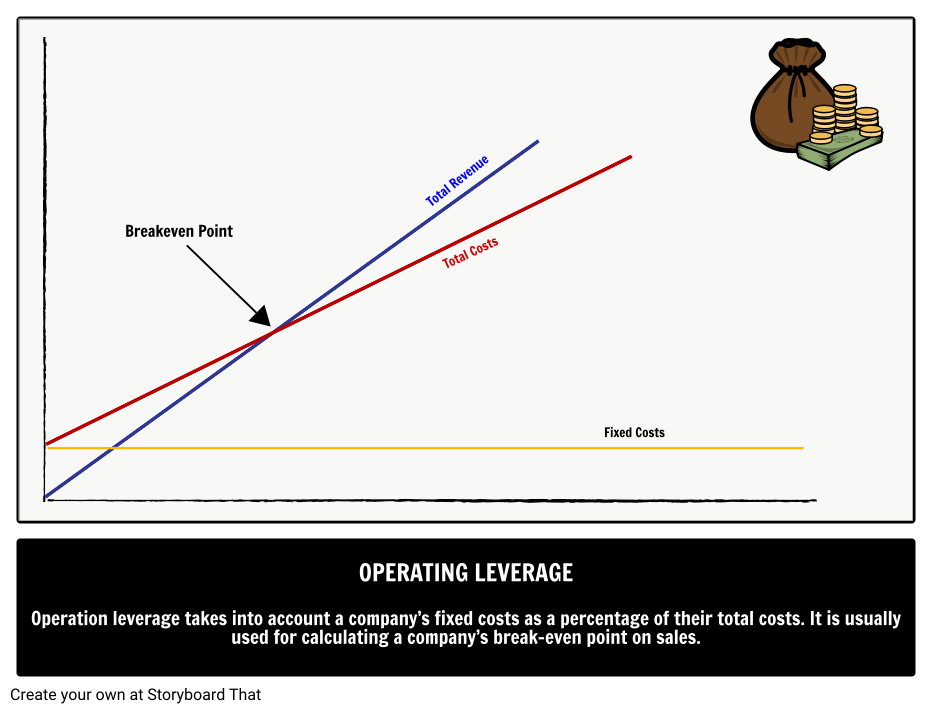

- The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales.

- Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes.

- This formula is useful because you do not need in-depth knowledge of a company’s cost accounting, such as their fixed costs or variable costs per unit.

- For instance, a 10% increase in sales for a company with low DOL might result in a less than 10% increase in EBIT, indicating a more stable, albeit less responsive, profit scenario.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

How to Use a Degree of Operating Leverage Calculator

Although high operating leverage can often benefit companies, companies with high operating leverage are also vulnerable to sharp economic and business cycle swings. Even a rough idea of a firm’s operating leverage can tell you a lot about a company’s prospects. In this article, we’ll give you a detailed guide to understanding operating leverage. At the end of the day, operating leverage can tell managers, investors, creditors, and analysts how risky a company may be. Although a high DOL can be beneficial to the firm, often, firms with high DOL can be vulnerable to business cyclicality and changing macroeconomic conditions.

The Operating Leverage Formula Is:

It is calculated as the percentage change in EPS divided by a percentage change in EBIT. Although revenues increase year-over-year, operating income decreases, so the degree of operating leverage is negative. This means that for a 10% increase in revenue, there was a corresponding 7.42% decrease in operating income (10% x -0.742). Yes, industries that are reliant on expensive infrastructure or machinery tend to have high operating leverage. For example, airlines have high operating leverage because the cost of carrying an additional passenger on a plane is quite low.

Operating Leverage Formula 4: Contribution Margin or Gross Margin / Operating Margin

A high DOL indicates that a company has a higher proportion of fixed costs, leading to greater sensitivity in operating income to changes in sales. The Degree of Operating Leverage debtor definition and meaning (DOL) indicates how sensitive a company’s operating income is to changes in sales volume. Low operating leverage industries include restaurant and retail industries.

Can I Use DOL to Compare Different Companies?

It’s like a financial magnifying glass, showing how your fixed and variable costs can amplify changes in sales into larger changes in operating income. In finance, companies assess their business risk by capturing a variety of factors that may result in lower-than-anticipated profits or losses. One of the most important factors that affect a company’s business risk is operating leverage; it occurs when a company must incur fixed costs during the production of its goods and services.

How confident are you in your long term financial plan?

In the final section, we’ll go through an example projection of a company with a high fixed cost structure and calculate the DOL using the 1st formula from earlier. When a company’s revenue increases, having a high degree of leverage tends to be beneficial to its profit margins and FCFs. Suppose the operating income (EBIT) of a company grew from 10k to 15k (50% increase) and revenue grew from 20k to 25k (25% increase). One important point to be noted is that if the company is operating at the break-even level (i.e., the contribution is equal to the fixed costs and EBIT is zero), then defining DOL becomes difficult. However, if the company’s expected sales are 240 units, then the change from this level would have a DOL of 3.27 times. This example indicates that the company will have different DOL values at different levels of operations.

In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed. However, if revenue declines, the leverage can end up being detrimental to the margins of the company because the company is restricted in its ability to implement potential cost-cutting measures. Or, if revenue fell by 10%, then that would result in a 20.0% decrease in operating income. However, operating leverage directly influences the sales level and is called first-order leverage, whereas FL indirectly influences sales and is called second-order leverage.

If you try different combinations of EBIT values and sales on our smart degree of operating leverage calculator, you will find out that several messages are displayed. Given the points above, the operating leverage metric is MOST meaningful when you calculate it for companies in the same industry with roughly the same operating margins (i.e., the comparable companies). These companies with high operating leverage and low margins tend to have much more volatile earnings per share figures and share prices, and they might find it difficult to raise financing on favorable terms. With operating leverage, the higher potential rewards come if the company increases its sales – which will translate into higher Operating Income and Net Income. However, most companies do not explicitly spell out their fixed vs. variable costs, so in practice, this formula may not be realistic. Therefore, high operating leverage is not inherently good or bad for companies.

Operating Leverage is controlled by purchasing or outsourcing some of the company’s processes or services instead of keeping it integral to the company. Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low. Examples of financial leverage usage include using debt to buy a house, borrowing money from the bank to start a store and bonds issued by companies. To cover the total risk and to be precise in their decision, the financial manager may rely on combined leverage. This is because there may not be enough sales revenue to cover the interest payments.

Leave a Comment