The race to become an EV battery supply chain giant

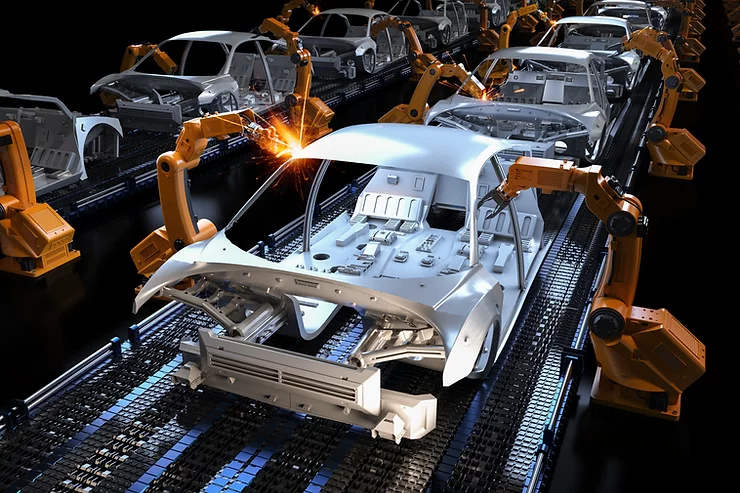

Electric vehicles have been the recent attraction and in trend while in search of alternatives to fossil fuel. Many technologies have been realized to replace fossil fuels and their emissions to ensure emission-free clean energy generation to reduce carbon footprint. Focusing on mobility, the candidates racing are Hydrogen and Electric solutions. Amongst the two, Electric solutions have been leading the race where many multinational companies and research institutes have been working on the development of battery technology and promoting EVs to be a promising future. Companies like Tesla, Lucid Motors, BMW, Toyota, Volkswagen, Mercedes, Honda is naming a few, are all completely invested in the race to develop EVs as the next-gen mobility solution.

There is another parallel race for the development and manufacturing of EV batteries. China has become the major country in battery manufacturing along with Japan, South Korea, and the US. The race for electric vehicles and batteries has been so intense, that automotive manufacturers have partnered with multiple battery companies dedicating batteries for their respective EV segments. Many automotive manufacturers are trying out their options with multiple partnerships with different battery companies.

Speaking about Volkswagen, the German automobile giant has partnered with almost all rivals in the battery manufacturing industry. In China, VW partnered with CATL, In S.Korea VW has partnered with the tier 1 battery manufacturers SK Innovation, Samsung SDI and LG Chem; along with companies like Quantum Scape, NorthVolt, and SMA Solar. VW has its other partnerships with automotive companies as well. Not Just VW, Japanese giant Toyota has been rushing for partnerships in China with its recent partnership with CATL and BYD.

Overall, China has been promoting EVs and many EV manufacturers across the globe are partnering with Chinese giants either for battery technology or other technology adoption. By the end of 2018, China accounted for about 35% EVs sold around the world. China happens to hold the key to raw materials and chemicals and is a major player in the production of Lithium. It ranks number 3 in Lithium production after Australia and Chile. China is not relying just on these large reserves and is securing supplies of materials such as lithium, nickel, and rare earths by investing in other countries as well. Overall, Chinese mining companies account for 62% of the cobalt’s global supply. They being a mass producer and supplier also regulate and limit the overall per-kiloWatt battery costs.

In this fight to dominate the EV market and battery supply chain, Elon Musk’s Tesla has also been in the race for EV manufacturing and has partnered with Japanese battery manufacturer Panasonic which produces its prismatic batteries for Tesla models at its Gigafactory in Nevada. Tesla acquired Maxwell Technologies, which developed Super-capacitor for EVs. The acquisition and partnership together could not compare with the Chinese battery manufacturer giant CATL, who is all set to surpass Tesla in battery production after the 13.1 billion yuan (US$2 billion) to finance the construction of a battery-cell plant. CATL would soon become a leader in battery production ahead of Tesla, BYD and LG Chem.

China has been aiming to capture the EV and battery market as their partnerships enabled them to form flagship factories outside China. BMW has invested €4 billion in CATL for its battery plant in Germany. Honda has too signed a 56 GWh Battery Cooperation Agreement on EV battery development. Other than CATL, other Chinese battery manufacturers BAIC, BYD and Lishen have also been partnering with EV manufacturers. Daimler has partnered with BAIC by purchasing a 5% stake in the Daimler. BYD has also secured a new EV bus plant in Canada. Aiming at the Indian EV market, Warren Buffet backed BYD has formed a JV with an electric bus manufacturer Olectra Greentech Ltd. with this JV BYD has two manufacturing units in India.

Considering the battery manufacturing giants CATL, BYD, Lishen and LG Chem (Chinese manufacturing facility) can produce batteries over 180 GWh/year capacity to power approx. 2,000,000 cars a year. Also, major EV manufacturers have been trying to access the Chinese market by partnering with the battery manufacturers, which gives China an upper hand in the dominance in battery and EV market.

To deep dive and stay continuously updated about the most recent global innovations in Energy Storage and learn more about applications in your industry, test drive WhatNext now!

Leave a Comment